inherited annuity taxation irs

Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. If a beneficiary inherits this type of annuity they will be required to pay taxes on the growth.

Most Americans Think They Re Taking All Their Entitled Deductions Are You Traditional Ira Required Minimum Distribution Roth Ira

My mom cashed hers out completely and they withheld the 10 for taxes.

. If you choose to disperse the payments over an. How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary. Unlike other investments the named beneficiary of a nonqualified annuity does not get a step-up in tax basis to the date of death.

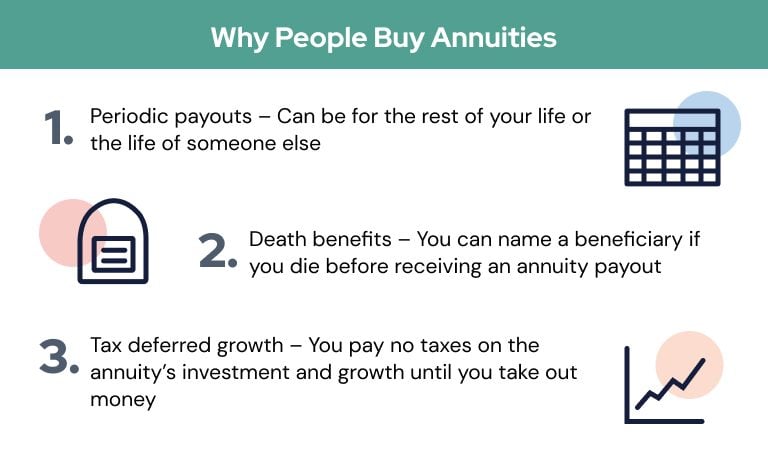

So if you have an annuity that promises payments for the next 10 years you could sell five years of these payments. You live longer than 10 years. Tax-sheltered annuity plan section 403b plan d.

Tax-sheltered annuity plans 403b plans. When you receive form 1099-R from the Trustee or the Financial Institution who is managing the Annuity you will follow the instructions in the FAQ below. You should receive a Form 1099-R from the payer of.

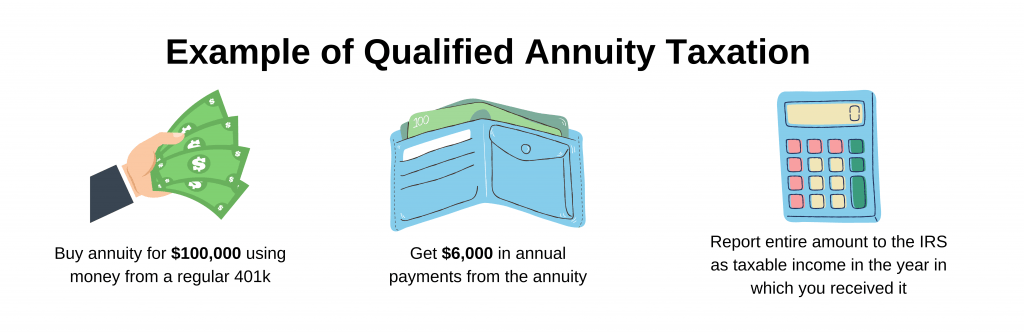

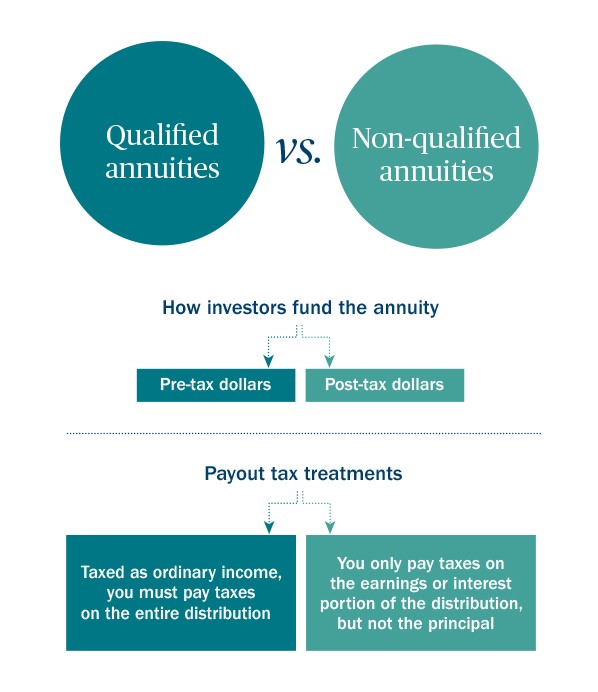

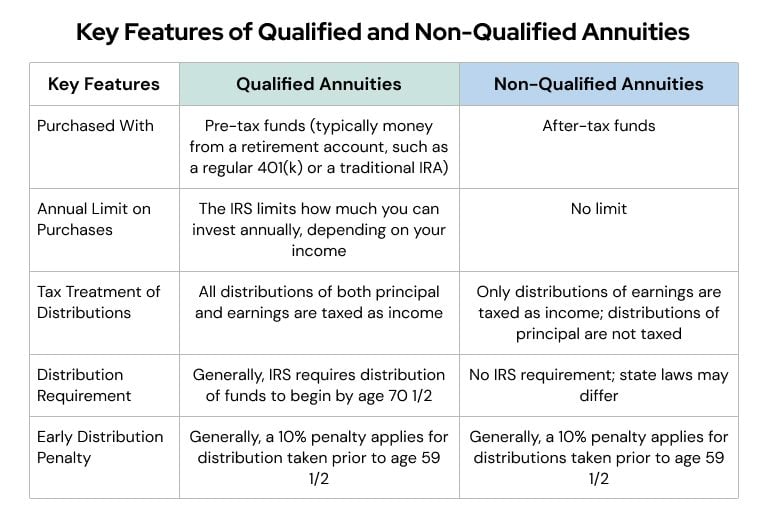

If you opt to receive a lump-sum payment of all funds within the annuity you will be taxed for the full amount at one time in keeping with standard income tax regulations. If you want to understand how an inherited annuity is taxed two terms that are critical to grasp are qualified annuities and non-qualified annuities. Deferred compensation plan of a state or local government section 457b plan or.

You actually have two options if you decide to part with the inherited annuity. Non-qualified annuities are generally funded with after-tax contributions. You have an annuity purchased for 40000 with after-tax money.

If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed. Here you would sell a period of the annuity disbursement or a portion of each payment. The internal revenue service IRS taxes annuity income to the extent of gains distributed from the contract and gains are distributed first.

One you might not have heard of is called an annuity stretch It gives non-spouse beneficiaries a way to receive income and defer taxes. Ad Stop Waiting for Your Inheritance to Clear Probate. Inherited Annuity Tax Implications.

The answer to this question depends on the type of annuity you have. Treat himself or herself as the beneficiary rather than treating the. A Company You Can Trust.

The insurance company. An annuity is qualified if you purchase it with pre-tax dollars via a tax-advantaged account such as an IRA or 401k. This allows partners to enjoy the same tax-deferred benefits as the original annuity owner.

Get Your Inheritance Money Now. If a trust charity or estate is the beneficiary of a non-qualified deferred annuity the five-year rule is the only rule they must abide by. The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the annuity.

Specialized in Inheritance Advances For Over 25 Years. Different tax consequences exist for spouse versus non-spouse beneficiaries. The first is a partial sale.

In other words you have to pay ordinary income tax on the earnings part of your distributions. So both my mom and I inherited separate annuity accounts from my dads death life insurance policies that were annuity accounts. For example if your annuity is part of an employer-sponsored retirement plan like a 401k or a SIMPLE IRA you may be able to make pre-tax contributions.

These annuities have already been subject to income tax however any interest earned will be taxed upon withdrawal. Annual payments of 4000 10 of your original investment is non-taxable. The money you receive beyond that 10-year-life expectation will be taxed as income.

If you have a qualified annuity contributions may be tax deductible up to a certain amount. That means that if the estate is large enough its possible it will owe. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is taxed.

These payments are not tax-free however. An inherited IRA is considered part of a deceased persons estate. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

However that doesnt mean the beneficiary will have. Tax obligations may possibly be deferred by rolling the lump-sum distribution over into an individual retirement account. A non-qualified annuity is an investment purchased outside of a work-related retirement plan using after-tax dollars.

Qualified employee annuity plan section 403a plan c. The earnings are taxable over the life of the payments. Tax Consequences of Inherited Annuities.

But there is no 10 early withdrawal penalty to worry about and you dont have to deal with RMDs either. If you work for a public school or certain tax-exempt organizations you may be eligible to participate in a 403b retirement plan offered by your employer. According to the IRS.

If the annuity is an immediate annuity the entire payout is taxed as ordinary income in the year it is received. However contributions are not tax deductible if you have a non-qualified annuity. Some states levy inheritance taxes on taxpayers based on the amount of the inheritance received.

In turn taxation of. Tax Rules for Inherited Annuities. One of the.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. The IRS treats distributions paid to an annuitant from qualified. Qualified annuities are typically set up through employer-sponsored retirement plans such as 401 k.

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. According to the Internal Revenue Service spouses calculate the. What youll pay in taxes for an inherited annuity can depend on whether the annuity is qualified or non-qualified.

If they choose a lump sum beneficiaries must pay owed taxes. The inheritor receiving the annuity must file the appropriate state tax forms to report inherited. Although this publication covers the treatment of benefits under 403b plans and discusses in-plan Roth rollovers from 403b plans to.

An annuity funded with pre-tax dollars is often a qualified annuity. Surviving spouses can change the original contract into their own name. Im now trying to do her taxes on turbo tax and its saying that she owes ANOTHER 10 Federal and half that amount to state.

It will be quite simple entering a 1099-R is like entering the information from a W2 you only enter the information from the boxes that contain information. May 31 2019 1151 PM.

Annuity Beneficiaries Inheriting An Annuity After Death

Understanding Annuities And Taxes Mistakes People Make Due

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxation And Distribution

How To Avoid Paying Taxes On An Inherited Annuity

Annuities Explained Information Annuity Basics

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Annuity Taxation How Various Annuities Are Taxed

Annuity Exclusion Ratio What It Is And How It Works

Annuity Beneficiaries Inheriting An Annuity After Death